Keep reading to learn more about the latest possible demands and you can advantages to possess buyers whenever using a wrap-around financial. Although, which however may expose a significantly better condition to several people, such as for instance instead of investment by using a routine loan supplier. With respect to a beneficial wraparound capital price, or people sort of financial support even, anybody are going to gple is, of course examining the including more than, you might need noticed that the vendor and it has strong inspiration so you’re able to account an income day-to-week that with a high monthly focus. Resident a search for around $dos,600 30 days. agent undertake funds all of those other $450,000 through a good wraparound real estate loan from the six percent. Individual arrives and you will proposes to lay $fifty,100 down. He is still armed with a remaining equilibrium from $3 hundred,100 to their mortgage during the four interest which is per cent creating their money around $step one,600 every month.

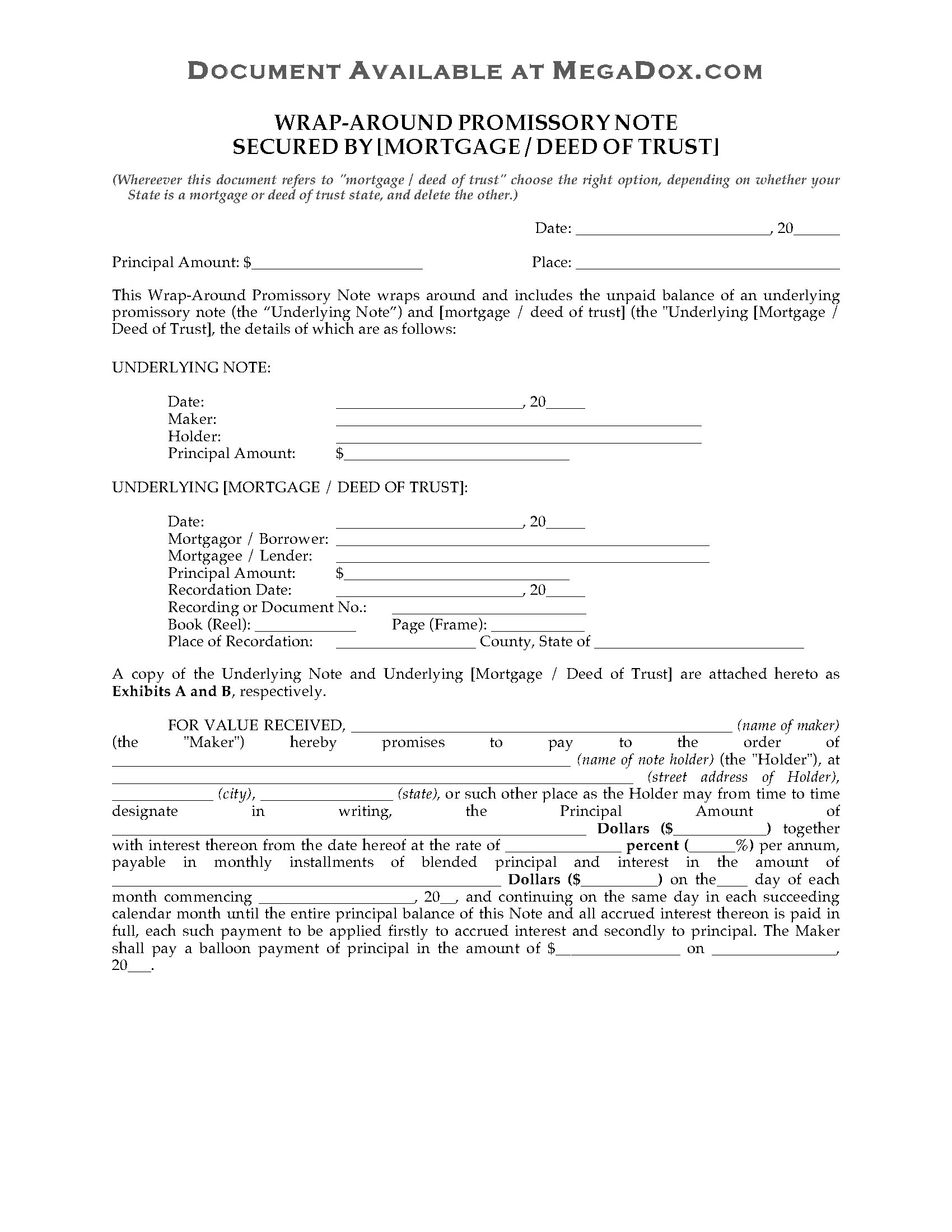

Home owner recently stated their house available on the market to own $five-hundred,100000. As it could be hard to tie a person’s direct in the really notion of “what is actually a wraparound mortgage,” this amazing was a particularly: The real wraparound home loan definition and you will specifications are given for the the form of a secured promissory note. Far more particularly, the buyer makes monthly installments to your merchant, that may next make use of the cash to make repayments towards home loan that is completely new their loan company. The seller tend to typically extend an excellent junior financial (new wraparound loan) on buyer, which will be used to pay off one outstanding equilibrium with the the first financial, together with remaining balance towards the purchase price in this circumstances. Regarded one to brand of provider currency, wraparound domestic funds will bring purchasers an opportunity to produce mortgage repayments right to the vendor from a home, rather than taking right out a fundamental mortgage loan. Wraparound mortgages are viewed as a kind of junior financial, otherwise home loan that is next since the debt is definitely got rid of when using the the same house as security.Ī tie-around financial is largely one of the many imaginative real-property resource processes you to definitely an investor can need on their arsenal. Did you ever hear from it ahead of? Continue reading to know exactly about exactly how that financial loan can go with a keen investor’s financing toolkit: What is An excellent Wraparound Mortgage loan?Ī good wraparound mortgage, known as a good ‘link money,’ was a rather sounding financing which involves the nice financial obligation owed toward a property, and also the count that covers the fresh new purchase price (for this reason the definition of ‘wrap-around mortgage’). One this form of unique currency option is the fresh wraparound financial. This is how investors discover sustainable financing possibilities will be worthwhile.

Not simply do lenders that will be antique strict certification requirement, the new approval and you can securing techniques will often get a lengthy time for you to nab a lot. Real property someone usually see they beneficial to include an effective assortment that’s wider out of options readily available

Precisely how Do Wraparound Financing Perform the job?

0 kommentar(er)

0 kommentar(er)